A Proprietary trading firm, also known as a ‘Prop firm’, is an oasis for all kinds of traders and investors. Just like there is an array of traders with different trading styles and needs, there is also a mixture of Prop firms at one’s disposal to choose from. However, in the collection of these prop firms, The funded trader Program has emerged as a rising name in the financial market among traders and investors.

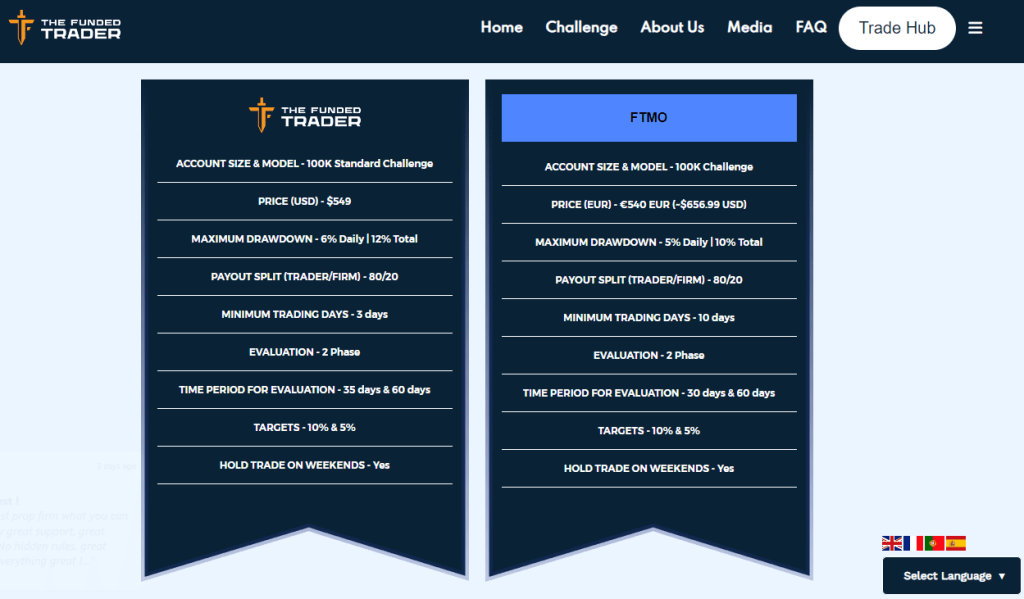

Even when The Funded trader Program was established recently, it has contained the interest of the trader’s community. The reason for the approval of this firm is that it is seen as an inclusion of all the Positive aspects of other Prop firms that are accessible in the market. The massive account sizes, realistic challenges, approachable conditions, and high success probability rate make The Funded trader Program a valued Prop firm in the financial domain.

Moreover, the funded trader program is affiliated with a genuine and reliable broker, Eight caps, making this prop firm a better choice for skilled, passionate, and consistent traders. After passing the 2 phase evaluation processes, the funded trader program enables its customers to earn 80% profit splits in live trading with up to 90% scaling options.

This review intends to put across all the information regarding the Funded trader Program in depth, including the funded program account options, detailed requirements of each program and challenges, all positive and negative aspects of the program, comparison with other prop firms, and most importantly why this firm is the best option available for any trader or investor.

What is The Funded Trader

The Funded Trader Program was initiated recently in the year 2021 and has emerged as the leading Prop firm in the financial market affiliated with the Eight caps as its official broker. Traders and investors of every type are associated with this firm and have endorsed this firm for successful trading. The goal of this firm is to provide the capital required to a trader or investor so that they can have the opportunity to trade with liquidity and reach a massive profit target with 90% profit splits.

The capital limit that is accommodated by the Funded Trader Program is up to $1,500,000, which can help potential traders to gain substantial profits, which is otherwise not possible due to a lack of investments. However, this trading capital can be earned by the traders after going through 2 phase trading challenges to prove their trading skills. Moreover, the trading instruments facilitated by this prop firm include a variety of Forex, Commodities, Indices, and Cryptocurrencies assets.

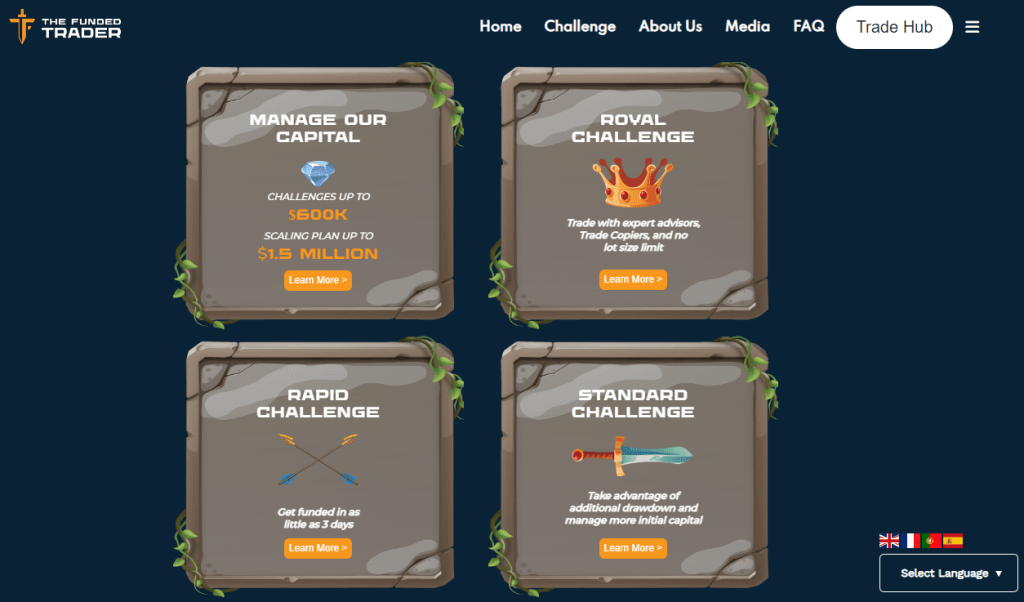

The Funded trader programs offer skilled traders the advantage of opting for two account options for the evaluation challenges. The first is the standard account, where evaluation takes place in two rounds. Second is the rapid challenge account which also comprises of two-step evaluation, and last is the Royal challenge program for capital investments worth $ 200,000. All challenges differ from each other in their specifications and are targeted at different sorts of trading experiences.

Advantages and Disadvantages of Trading with The Funded Trader

|

|

Benefits of Trading with The Funded Trader

There are many benefits to trading with a Prop firm, specifically for skilled traders who are struggling due to insufficient availability of capital for investments. However, it is not easy to work with prop firms without proving to be an exuberant trader who can sail the trading ship from uncertain market situations.

Similarly, The Funded Trader Program is one such competitive prop firm that provides tremendous opportunities to the traders by providing excessive investment funds to traders up to $ 150,000. Nevertheless, this program also poses great challenges to the traders so that they can prove their worth before capitalizing on these funds.

Another benefit of this prop firm is that it offers high leverage to clients with 100:1 in forex, which is 200: 1 during the evaluation challenge, 40: 1 for commodities, 20: 1 for indices, and 2: 1 for Cryptocurrencies, respectively. These leverage statistics are much higher than other prop firms offer, which is a great advantage.

One more plus of The funded trader program is that it offers its clients a vast choice of trading instruments. There is an option of more than 50 forex currency pairs to choose from in forex. Similarly, traders select from 7 trading alternatives in commodities 10 from indices, and more than 20 from Cryptocurrencies. So there are a lot of choices for the users to select the right asset for a profitable trading experience.

All in all, like some other prop trading firms, the evaluation conditions posed by the funded trader program are realistic and achievable by traders who follow the trading rules, apply effective trading strategies, and consistently work to reach their goals. Eventually, the reward given by the funded trader program to such traders in terms of the massive funds for trading is impressive.

The Funded Trader Pros and Cons

PROS

- Variety of trading instruments

- Realistic evaluation criteria

- Advances MT4 and MT5 trading Platform

- Assistance through the trader’s dashboard

- Fast payouts

CONS

- No free demo accounts

- Educational tools and resources are not present

Difficulties Met by the Traders who Participated in the Brokers Challenge

Even when FTMO is among the best proprietary trading firms, overcoming the broker sets challenges is not easy, and traders face many difficulties along the way. Some of these hurdles are mentioned below

#1. The 5% Daily Drawdown

One challenge arranged by the FTMO platform for the traders is the 5% daily draw down. Ths means that the traders only have the leverage to make losses of up to 5% of the investment. As it is difficult, especially for an inexperienced trader, to predict the price movement of any asset, they bear massive losses as the price action spikes. Therefore, the limit of 5% drawdown becomes a big obstacle for traders.

How to Overcome the Difficulty

Even when the obstacle of a 5% daily drawdown is significant, traders can overcome it by using some effective strategies. One way is to use technical analysis and tools to evaluate the price movement. Another way is to use the option of Stop-loss, where traders can order the advance selling of an asset before it reaches the 5% loss.

#2. High-Profit Targets

The task of achieving a high-profit target is troublesome for new traders, who are still struggling with the trading basics in the first phase. The profit target in the first challenge is about $ 1000 or 10% of the investment. This has to be achieved within 30 days to pass through the first stage.

How to Overcome the Difficulty

Making a 10% profit in 30 days is a task that seems formidable. However, to overcome this difficulty, traders need to go slow and steady. Rather than achieving the target in one shot, traders can go for a small trading volume with an achievable profit target. With consistency, it would be possible to get this done within the given time limit.

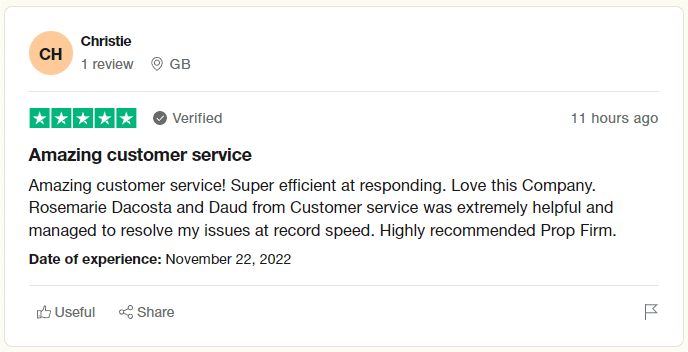

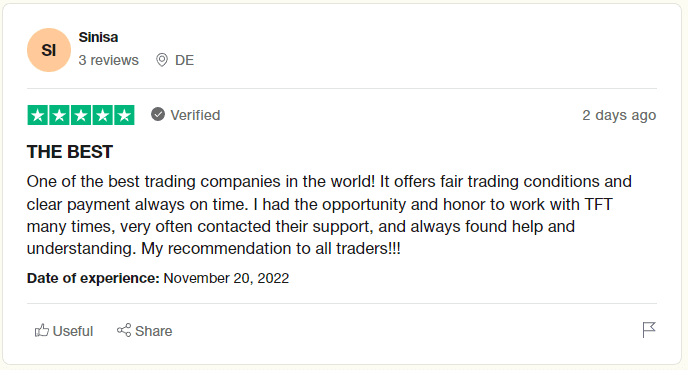

The Funded Trader Program Customer Reviews

|

|

|

The reviews of the customers serve as a mirror of performance for any company. Since feedback from the users can exactly tell us the real trader’s experience, it is important while analyzing any firm’s competencies. The same is the case with the funded trader’s program, where the reviews of the customers can guide the potential clients

According to the majority of the reviews that we read and assessed, the traders seemed satisfied and contended with the services of this program. The users did not complain regarding the challenges they faced during the evaluation period of the program, in fact, it was taken as a good step for training and preparation for real-time trading.

In the same way, the customer support of this prop firm was also highly appreciated even when the firm did not offer any direct or urgent assistance. Customer support is not present through phone calls or physical assistance. However, prompt response from live chat and email options has been quite productive for the users.

Most clients shared their success stories and how they easily managed to earn big-figure profits through the funded trader program. Similarly, there were no reviews that reflected slow payouts or difficult withdrawal procedures, which is quite often an issue for traders. Hence, the feedback and response of the present customers are positive and encouraging for future clients.

The Funded Trader Fees and Commissions

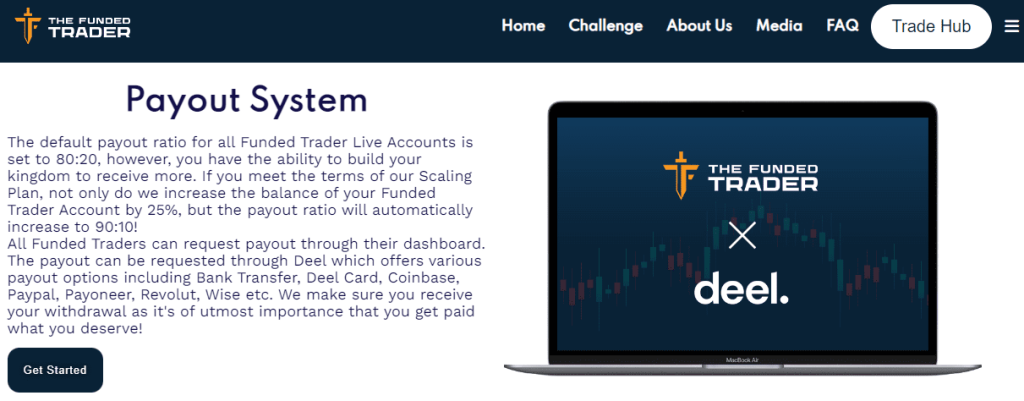

The funded trader program has a fixed commission rate of $5 per lot on each instrument, including Forex, indices, commodities, and Cryptocurrencies as well. The commission increases per lot. For instance, 25 for 5 lots, $50 for 10 lots, and so on. The $5 commission may seem to be high compared to some other prop firms however, it is in benefit for the trader in the long term.

This is because the commission rate of the funded trader program is fixed so no matter how much the trader earns, the commission remains the same. This is more profitable for traders compared to other commission procedures, where a certain percentage is charged according to the trading transactions.

As far as other fees are concerned, there are no additional fees or charges that are applied on the withdrawal or deposit of funds. However, third-party transaction charges may apply. Moreover, another cost that traders have to pay is the subscription charges for the challenge accounts. Even though this fee is refundable, one still has to pay according to the challenge, and there are no free demo accounts

The first and basic standard challenge account has the highest subscription fee of $1898. The Rapid challenge has a refundable fee of $ 899, and the Royal challenge phase has a handsome fee of $ 1399. These charges clearly suggest that this program is for real-time traders who want to do serious trading and not for traders who lack the skills or intent.

Account Types

The account types of the Funded trader program are not just like any typical account that a trades open with any online broker. The funded trader accounts are actually evaluation procedures or, as they are called, ‘challenges’ to allow the trades to go through a trial trading condition. Each of these evaluation accounts has phases and time limits, after which the trader gets the green signal to do real-time trading.

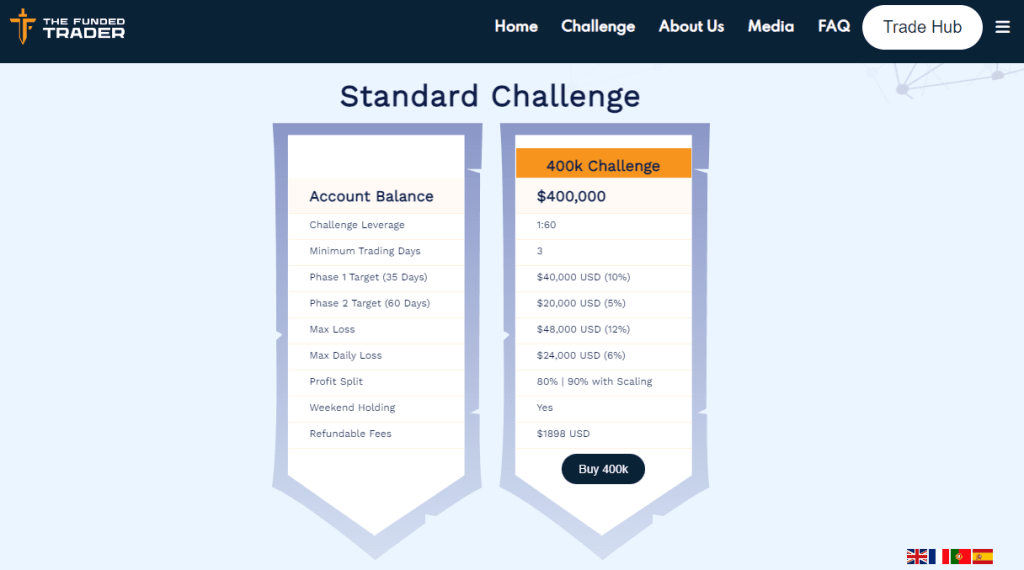

The Standard Challenge Account

The First evaluation account is the Standard challenge account. The capital limit of this account has a range starting from $5000 up to $400,000. Within this standard challenge account, there are also two options for customers. The first option is the regular challenge, and the second is the swing challenge. Both these options within the standard challenge also have different specifications. For example, the leverage for regular account value is 1: 200, whereas, for the swing account value, the leverage is 1: 60.

Other features of the regular and swing account are the same, with each having the same number of trading days (3), phase 1 (35 days), and phase 2 (60 days) targets of 10% and 5%, with maximum overall (12%) and daily loss(6%) and the subscription fees as well which is $ 1989. There is one major difference that keeps the regular and swing accounts apart, and that is their weekend holdings. Swing accounts allow weekend holdings, whereas regular account does not.

The Rapid Challenge Account

The account balance for the Rapid challenge account makes it different from the standard challenge account. The range of capital starts from $50,000 and goes up to $200,000. Moreover, Just like the standard challenge account, this account type also has two options regular and swing accounts for traders.

In the regular account for the rapid challenge evaluation, the leverage is 1:100, phase 1 (30 days) trading target is $16000 (8%), phase 2 (60 days) trading target is $10000 (5%) Max loss is 8%, and daily loss limit is 5%. The profit split is 80%, with the scaling option of increasing up to 90%.

There is no weekend holding in the regular account option, and the subscription fee is less than the standard fee, which is $899. The only difference between the swing account is that it has lower leverage of 1: 30 however it allows weekend holdings.

The Royal Challenge Account

The Last course of action for traders is the Royal Challenge phase. This evaluation account does not have any alternatives for swing or regular accounts, and traders who choose the Royal challenge will have to follow the only set of given features.

The account value of the Royal challenge account sizes starts from $50,000, reaching up to $300,000. The leverage is higher than the Rapid challenge account of 1:200. Additionally, The 35 days phase 1 has a trading target of $24,000, making 8% of the total value, and phase 2 has a 60 days target of $15000, which is 5% of the trading balance. The overall maximum loss limit is 10%, whereas the daily loss limit is 5%.

The additional advantage of the Royal challenge account is that it offers constructive financial advice from trading experts that can help traders to a great extent. The profit split is also high starting from 80 % and leading to 90% after the scaling plan. The refundable fee for this Royal challenge account type is $ 1399, less than the standard account type.

How To Open Your Account?

Opening funded trading accounts with the funded trader program is a fast and convenient process. However, one should keep in mind that opening a trading account with this Prop firm is not just like opening a trader’s account with a broker.

The major difference is that before doing any kind of live trading, a trader must go through an evaluation account, also known as the evaluation challenge. If the trader passes through the criteria of each evaluation program, only then will they be eligible to switch to real-time trading.

For this reason, the first step towards opening an evaluation or challenge trading account is to go through the official website of the Funded Traders Program. On the very first page, there is an option of “Start Challenge,” and by clicking on this tab, the user will be redirected to the challenging trading account selection page.

On the selection page, the user can view all the challenge-funded accounts the firm offers. Along with the list, a complete detail with specifications is also mentioned with each funded account, making it easier for the user to select. Once the user selects a funded trader account and clicks ‘buy’, the website opens the billing details page.

The funded trader account registration page has a form to be filled in with all the correct user personal information. From the name, email, phone number, nationality, zip code, and billing address. This page also requires the user to fill out details about the trading account that they are buying, including account sizes, trading platform, broker selection, and account type.

The billing details also include the Credit or debit card details for online payment of the account subscription fee. There is also an option available for Cryptocurrency payment, including Bitcoin and others. Lastly, after reading and agreeing to the terms, conditions, refund, and dispute policies, the user can Place an Order for the selected funded trading accounts.

What Can You Trade on The Funded Trader

Traders have multiple options of all major trading instruments on the funded accounts, including Forex currency pairs, Indices, Commodities, and Cryptocurrencies. Since the authorized broker of the funded accounts is Eightcap, therefore all trading instruments provided by this broker are accessible through a funded account.

Forex

In the Forex league, all major and minor currency pairs, with a total of 40 pairs, can be traded in the funded account. During the evaluation process, the trader gets the high leverage of 200: 1 for buying and selling of forex pairs, whereas the leverage in live accounts for forex is 100: 1. The low leverage compared to the evaluation period is an advantage for the retail forex traders as high leverage can lead to great losses if the market conditions are not supportive.

Commodities

With the partnered broker Eight caps, this prop firm offers funded trading accounts and provides traders the opportunity to trade in commodities, including raw materials as well as metals and oil, etc. The leverage that funded account holders get is 40: 1, and the commission fee is $5 per lot. Hence, traders can take long or short positions in commodities by taking an informed decision about investment.

Indices

A trader can make a profit through the eight most in-demand indices or Index CFDs through a funded account. In trading these indices, the customer can either take a long or short position with more than one index from the same account. Moreover, the leverage given to the funded accounts is 20: 1, which is high, and traders can use this liquidity for a massive profit target.

Cryptocurrencies

Cryptocurrencies were recently introduced on the Funded trader program due to their high demand and popularity among traders. Not just this most sought-after trading instrument is now available on this prop firm, but it also offers the widest range of Cryptocurrencies leading to more than 100 digital currency options like no other competitor.

Moreover, the biggest advantage of trading Crypto on funded accounts is that the trader gets the tightest spreads and high liquidity of 2: 1 which any other Prop firm rarely offers. In addition to this, the fast order executions and advanced trading platforms, including Trading View, MT4, and Mt5, also make trading Crypto profitable for traders.